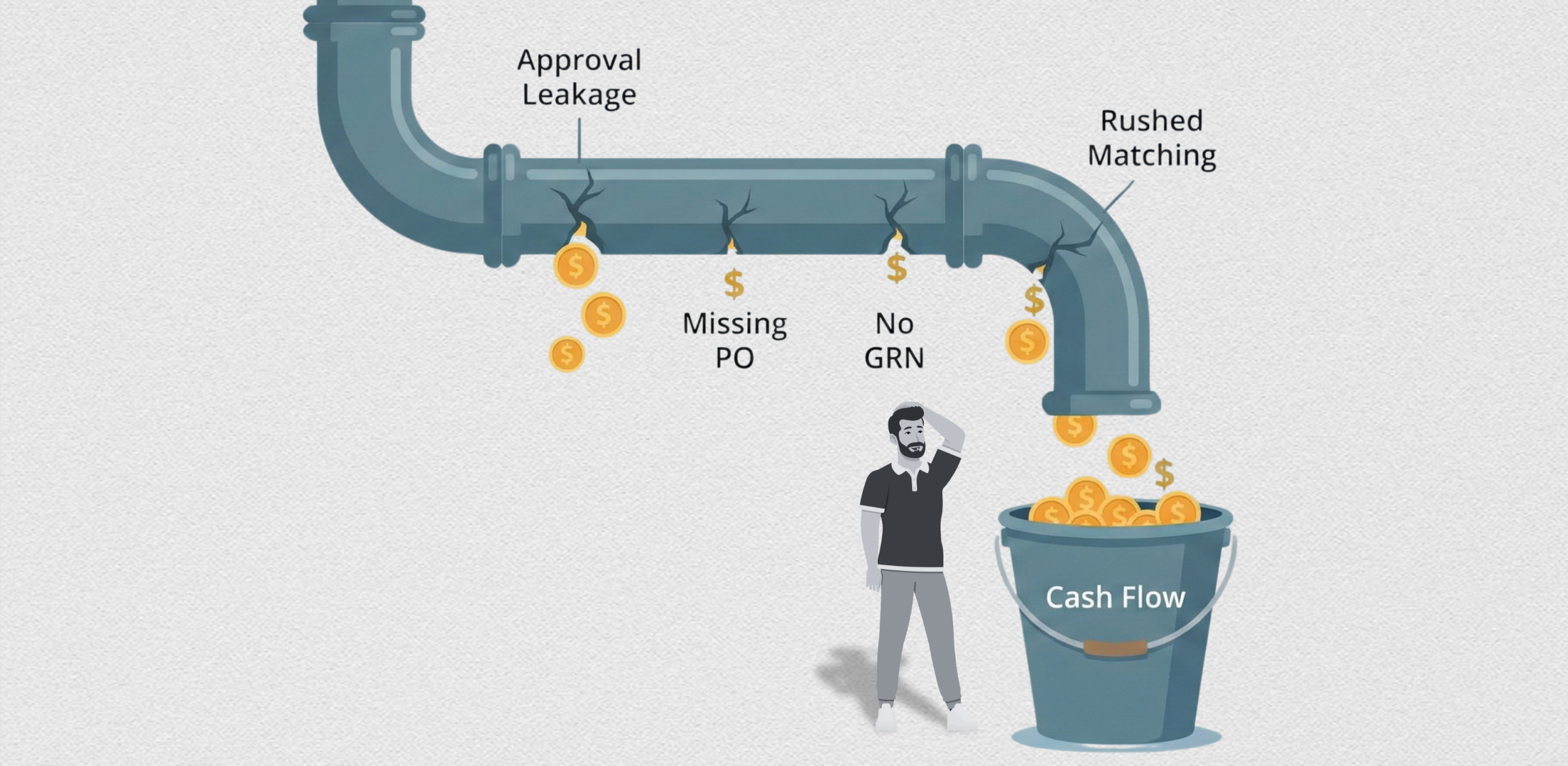

If surprise spending is messing with cash flow, you’re not alone. Most businesses don’t overspend because people are reckless. They overspend because spending happens in the gaps: a quick approval in a message thread, a supplier starting work without a PO, delivery proof missing, and invoices being approved under pressure.

Here’s the practical truth we’ve learned from years of helping teams improve spend control: you don’t fix surprise spending with a long policy document. You fix it with a repeatable weekly habit that makes spend visible early, while it’s still controllable.

In this blog, you’ll get a simple 30 to 45 minute weekly routine to tighten approvals, PO discipline, proof of delivery/GRN capture, and invoice checks. You’ll also get a copy-paste weekly report template so you can run this consistently.

If you’re searching for how to stop surprise spending and protect cash flow with a weekly routine, start with the steps below.

Where spend hides (and why it turns into invoice shock)

Surprise spend is usually one of these four gaps:

1) Approval leakage

A purchase gets verbally agreed, approved via email/WhatsApp, or “assumed approved” because it feels urgent. Finance only sees it when the invoice arrives.

A purchase approval workflow is simply the step-by-step route a request takes to get authorised before you commit money. When approvals aren’t traceable, consistent, and tied to thresholds, spend leaks.

2) Weak PO discipline (or no PO at all)

A strong purchase order approval process is one of the clearest controls for preventing uncontrolled spend. When POs are optional, raised after the fact, or missing key details (scope, unit price, delivery date, cost code), invoice checking becomes guesswork.

“No PO” invoices are where surprise spending breeds fast, because there’s no reliable record of what was agreed.

3) Missing proof of delivery / GRN

If proof of delivery, GRNs, or completion sign-offs are inconsistent, you risk paying for incorrect quantities, disputed work, or items that never arrived. Proof is what turns “we think” into “we know”.

4) Rushed invoice matching

Invoice matching is where surprise spend becomes real cash, leaving the business. When AP teams are under pressure, invoices get approved based on urgency instead of accuracy.

A standard control is three-way matching: compare the PO, the delivery receipt/GRN, and the supplier invoice before approving payment. It reduces overbilling, duplicates, and disputes.

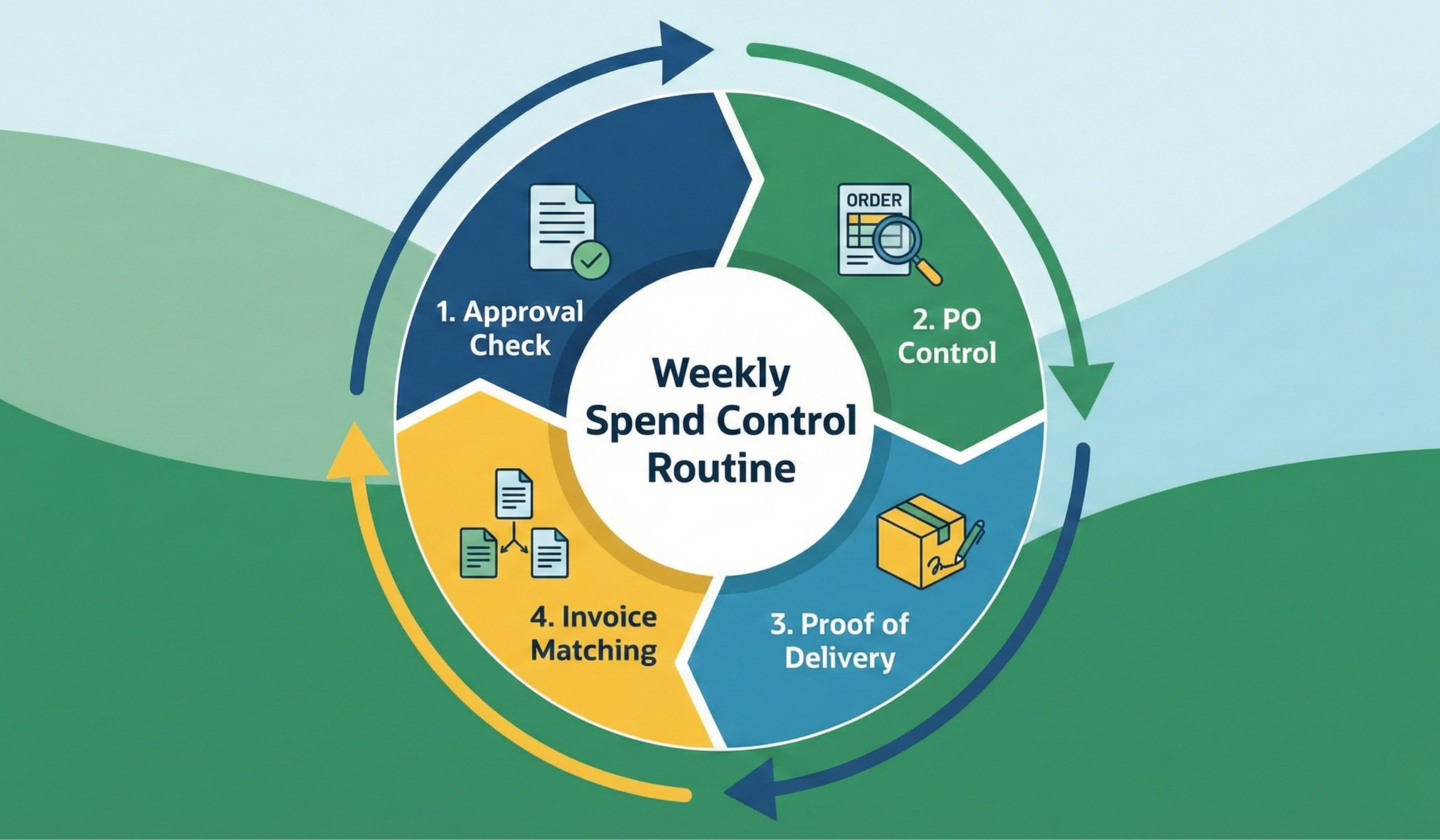

The weekly routine (30–45 minutes)

Run this once a week with Finance/AP + Procurement/Commercial + an Ops lead (someone close to what was ordered and what was received). Keep it the same day/time each week. Consistency beats intensity.

Step 1: Approval check (10 minutes)

Goal: Confirm what’s approved before it becomes unavoidable.

Do this quickly:

- Review new purchase requests raised this week.

- Check each one has: supplier, amount, cost code/project, brief justification, and required approver.

- Flag anything approved “after the fact” and fix the cause (unclear thresholds, missing owner, slow approvals).

Output: a short list of Approved / Rejected / Pending requests, each with an owner and deadline.

Micro-promise: If you do only this step weekly, you’ll reduce “we didn’t know about this” invoices within a few weeks.

Step 2: PO control check (10 to 15 minutes)

Goal: Make POs your early warning system for cash flow.

Ask four questions:

- What POs were raised this week, and are there any unusual spikes by supplier/category/value?

- Are there split orders that look like threshold avoidance?

- What POs are still open, and which ones are stale or duplicated?

- Which invoices arrived with no PO?

This is where you stop surprise spending before it hits the ledger. POs show what you’re about to spend, not what you’ve already spent.

Step 3: Proof of delivery / GRN check (5 to 10 minutes)

Goal: Don’t pay for what wasn’t received or accepted.

Focus only on the high-impact items:

- Review the top deliveries/services by value.

- Confirm proof exists (delivery note, GRN, sign-off email, photo evidence, completion confirmation).

- Assign one owner to chase missing proof before payment runs.

Output: a short “blocked until proof received” list with owners.

Step 4: Invoice matching check (10 minutes)

Goal: Pay accurately, not urgently.

Bucket invoices into:

- Matched (ready to pay)

- Mismatch (price/qty/scope doesn’t match)

- Missing PO

- Missing proof/GRN

- Duplicate risk

Then apply three-way matching to exceptions first. This prevents month-end “invoice archaeology”, where you’re chasing context no one remembers.

Output: cleaner payment runs and fewer supplier disputes.

What changes when you do this weekly

This routine works because it shifts control upstream:

- Fewer “we didn’t know about this” invoices

- Better visibility of committed spend before month-end

- Reduced invoice disputes through proof + matching

- More predictable cash flow and easier forecasting

- Less admin firefighting across teams

Most importantly, it creates a shared rhythm between ops, procurement, and finance so spend doesn’t slip through the cracks.

How CMS Desk supports this (without adding admin)

At CMS Desk, we see best results when organisations connect approvals, purchasing, receipt confirmation, and invoice checks in a single workflow rather than scattering them across disconnected tools.

If you want to reduce surprise spend, look for a solution that helps you:

- Enforce approvals and thresholds with a clear audit trail

- Raise and control POs consistently

- Capture proof of delivery/GRNs and link them to orders

- Run invoice checks and matching before payment approval

- Produce weekly spend snapshots without manual chasing

FAQ’s

1. What is a purchase order approval process?

A purchase order approval process is the workflow that authorises a purchase before a PO is issued, helping control spend, enforce thresholds, and improve accountability.

2. What is three-way matching in accounts payable?

Three-way matching checks that the PO, delivery receipt/GRN, and supplier invoice match before approving payment, reducing overbilling and disputes.

3. How do you reduce maverick spend?

Reduce maverick spend by enforcing approvals, requiring POs for meaningful purchases, and matching invoices to PO and receipt evidence.

4. How often should we review spending to protect cash flow?

Weekly is the sweet spot: frequent enough to catch issues early, light enough to sustain without extra admin.